Michael A. Weiss Age 70

Director Since: 2007 Age: 72 Chairman and CEO | | | | | Business Experience.Mr. Weiss has served as our President and Chief Executive Officer and as a member of our boardBoard of directorsDirectors since returning to our companyExpress in July 2007. In November 2011 he was appointed Chairman of the Board. From 2004 to July 2007, Mr. Weiss was retired, but he returned to Express in 2007 when it was acquired from Limited Brands by investment funds managed by Golden Gate Capital. HePrivate Equity, Inc. Mr. Weiss previously served as our President and Chief Executive Officer of Express from 1997 to 2004. Prior to that, he served as Vice Chairman of Limited Brands from 1993 to 1997. He served as our President of Express from 1982 to 1993 and prior to that served with Express when it was founded in 1980, starting as a merchandise manager for what was then an eight store experimental division of Limited Brands. In addition to his prior service as a director at Borders Group, Inc., Chico’s FAS, Inc. and Pacific Sunwear of California Inc., Mr. Weiss currently serves as a director at Collective Brands, Inc., a position he has held since 2005. As a result of these and other professional experiences, Mr. Weiss possesses particular knowledge and experience in retail and merchandising; branded apparel and consumer goods; and leadership of complex organizations that strengthen the Board’s collective qualifications, skills and experience. |

Class I Directors With Terms Continuing Until the 2014 Annual Meeting

Michael G. Archbold

Age 51

| Mr. Archbold has served as a member of our board of directors since January 2011. Mr. Archbold has served as President and Chief Operating Officer of Vitamin Shoppe, Inc. since April 4, 2011, and was its Executive Vice President, Chief Operating Officer and Chief Financial Officer since April 2007. Mr. Archbold served as Executive Vice President / Chief Financial and Administrative Officer of Saks Fifth Avenue from 2005 to 2007. From 2002 to 2005 he served as Chief Financial Officer for AutoZone, originally as Senior Vice President, and later as Executive Vice President. Mr. Archbold is an inactive Certified Public Accountant, and has 20 years of financial experience in the retail industry. Mr. Archbold previously served as a director of Borders Group, Inc. Mr. Archbold possesses particular knowledge, Chico’s FAS, Inc., Pacific Sunwear of California Inc., and experience in leadership, strategic planning, accounting, finance, capital structure and operations of retail organizations; and board practices of other major corporations that strengthen the Board’s collective qualifications, skills and experience.Collective Brands, Inc. |

| | Mr. Archbold serves on the Audit Committee. |

Peter Swinburn

| | | Select Qualifications, Skills and Experience: | | | | | Age 59

| Mr. Swinburn has served as a member of our Board of Directors since February 2012. Mr. Swinburn has served as Chief Executive Officer• Retail merchandising and President of Molson Coors Brewing Company since July 2008. He has also served as a director of Molson Coors Brewing Companyoperations• Apparel and MillerCoors since July 2008. From 2005 to October 2007, Mr. Swinburn served as President and Chief Executive Officer of Molson Coors Brewing Company (UK) Limited (“MCBC UK”). Prior to that, he served as President and Chief Executive Officer of Coors Brewing Worldwide and Chief Operating Officer of Molson Coors Brewing Company (UK) Limited following the Molson Coors Brewing Company’s acquisition of Molson Coors Brewing Company (UK) Limited in 2002 until 2003. As a result of these and other professional experiences, Mr. Swinburn possesses particular knowledge and experience in globalconsumer goods • Consumer brand marketing international operations, corporate governance,and advertising • Business development and strategic planning and leadership • Leadership of complex organizations that strengthen the Board’s collective qualifications, skills and experience. |

• Supply chain | Mr. Swinburn serves on the Compensation and Governance Committee. |

Corporate Governance Corporate Governance Principles The Board has adopted policies and procedures to ensure effective governance of Express. Our corporate governance materials, including our Corporate Governance Guidelines, the charters of the Audit Committee and Compensation and Governance Committee of the Board, of Directors, and our Code of Conduct may be viewed in the corporate governanceinvestor relations section of our website at www.express.com/investor. We will also provide any of the foregoing information in print without charge upon written request delivered to the Office of the Corporate Secretary, 1 Express Drive, Columbus, OH 43230. The Compensation and Governance Committee reviews our Corporate Governance Guidelines from time to time as necessary, but no less than annually, and may propose modifications to the principles and other key governance practices from time to time as warranted for adoption by the Board. Board Composition The Board is responsible for overseeing the affairs of the Company. The Board held eightsix meetings during 2011.2013. Each director attended at least 75% of Board and committee meetings held during the period inyear, as well as at least 75% of meetings of the committees on which he or she served during 2011.2013. Directors are expected to attend our annual meeting of stockholders. All of our current directors attended the 2011 Annual Meetingour 2013 annual meeting of Stockholders, except for those directors who joined the Board after the 2011 Annual Meeting.stockholders. The Board is divided into three classes. Each director serves a three-year term, and one class is elected at each year’s annual meeting of stockholders. Messrs. Archbold and Swinburn are Class I directors with terms expiring at our 2014 Annual Meeting. Messrs.Mr. Devine and Olshansky and Ms. Mangum are Class II directors with terms expiring at our 2012 Annual Meeting. Mr. Devine and Ms. Mangum have been nominated to serve as Class II directors for another three year term expiring at our 2015 Annual Meeting.annual meeting of stockholders. Messrs. Killion and Weiss and Ms. Chawla are Class III directors with terms expiring at our 2013 Annual Meeting.2016 annual meeting of stockholders. Messrs. Archbold and Swinburn have been nominated to serve as Class I directors for three-year terms expiring at our 2017 annual meeting of stockholders. Any additional directorships resulting from an increase in the size of the Board will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the total number of directors. Our Bylaws and Corporate Governance Guidelines provide for a majority voting standard in uncontested director elections. The standard states that in uncontested director elections, a director nominee must receive more votes cast for than against his or her election or re-election in order to be elected or re-elected to the Board. The Board expects a director to tender his or her resignation if he or she fails to receive the required number of votes for election or re-election. Our certificate of incorporation provides that, subject to any rights applicable to any then outstandingthen-outstanding preferred stock, the Board shall consist of such number of directors as is determined from time to time by resolution adopted by a majority of the total number of authorized directors, whether or not there existare any vacancies in previously authorized directorships. The Board currently consists of seven members, however, effective upon the election of the Class II directors at our Annual Meeting, the number of directors on the Board will automatically be reduced to six by resolution adopted by the Board.directors. Subject to any rights applicable to any then-outstanding preferred stock, any vacancies resulting from an increase in the size of the Board or otherwise may onlymust be filled by the directors then in office unless otherwise required by law or by a resolution passed by the Board. The term of office for each director will be until his or her successor is elected at an annual meeting of stockholders or his or her death, resignation or removal, whichever is earliest to occur. Board Leadership Structure Our Corporate Governance Guidelines provide that the roles of Chairman of the Board (the “Chairman”) and Chief Executive Officer may be separated or combined. The Board exercises its discretion in combining or separating these positions as it deems appropriate in light of prevailing circumstances.appropriate. The Board believes that the combination or separation of these positions should continue to be considered as part of the succession planning process. In the event that the Chairman and Chief Executive Officer roles are combined, the Board believes that it is beneficial for the independent directors to appoint an independent Lead Director. Michael Weiss currently serves as Chairman President and Chief Executive Officer. The Board believes that combining the roles of Chairman and Chief Executive Officer positions takes advantageis currently the most effective leadership structure for the Company for many reasons, including: (1) Mr. Weiss, in his dual role, brings a uniform vision to all aspects of the unique talentsCompany’s business; (2) a combined Chairman and CEO structure provides the Company with a single leader demonstrating clearer accountability to our stockholders; (3) the structure enhances transparency between management and the Board; and (4) Mr. Weiss has extensive knowledge of Mr. Weissall aspects of our business, operations, and effectively combinesrisks, which gives him the insight necessary to combine the responsibilities for strategyof strategic development and execution along with management of day-to-day operations. The independent directors of the boardBoard have elected Mylle Mangum to serve as Lead Director. The Lead Director serves in a variety of roles, including,including: (1) reviewing and approving Board and committee agendas and schedules to confirm that appropriate topics are reviewed and sufficient time is allocated to each; (2) providing input to the Chairman with respect to the information provided to the Board; (3) serving as liaison between the independent directors and the Chairman; (4) presiding at the executive sessions of independent directors and at all other meetings of the Board of Directors at which the Chairman is not present; (5) calling an executive session of independent directors at any time, consistent with the Corporate Governance Guidelines; (6) facilitating communications and coordination of activities among the committees and other directors as appropriate; (7) approving and coordinating the retention of advisors and consultants to the Board; and (8) such other responsibilities as the independent directors may designate from time to time. The independent directors are given an opportunity to meet in an executive session at each Board meeting, and each of the standing board committees is comprised solely of and led by independent directors. The Board believes that the combination of the Chairman and Chief Executive Officer roles, together withconducts a Lead Director and Board committees comprised only of independent directors provides an effective balance for the management of the Company in the best interests of Express stockholders. The Board conducts ancomprehensive annual self-evaluation to determine whether it and its committees are functioning effectively and oureffectively. Our Corporate Governance Guidelines provide the flexibility for the Board to modify our leadership structure in the future as appropriate. We believe that Express, like many other U.S. companies, is well-served by this flexible leadership structure.

Board Committees The Board currently has an Audit Committee and a Compensation and Governance Committee. The composition, duties, and responsibilities of these committees are as set forthdescribed below. In the future, the Board may establish other committees, as it deems appropriate, to assist it with its responsibilities. Each of theseThe committees reportsreport to the Board as they deem appropriate, and as the Board may request. Each committee operates under a charter that has been approved by the Board. | | | | | | Board Member | | Audit Committee | | Compensation and Governance

Committee | | | | | Michael G. Archbold | | X | | — | | | | | Sona Chawla | | | | X | | | | Michael F. Devine, III | | p | | — | | | | | Theo Killion | | — | | X | | | | | Joshua Olshansky

| | — | | — | | | | Mylle H. Mangum | | X | | p | | | | | Peter S. Swinburn | | — | | X | | | | | Michael A. Weiss | | — | | — |

pChair of the committee Audit Committee The Audit Committee is responsible for, among other matters: (1) appointing, compensating, retaining, evaluating, terminating, and overseeing our independent registered public accounting firm; (2) discussing with our independent registered public accounting firm their independence from management; (3) reviewing with our independent registered public accounting firm the scope and results of their audit; (4) approving all audit and permissible non-audit services to be performed by ourthe Company’s independent registered public accounting firm; (5) overseeing the financial reporting process and discussing with management and ourthe Company’s independent registered public accounting firm the interim and annual financial statements that we filethe Company files with the Securities and Exchange Commission (“SEC”);SEC; (6) reviewing and monitoring ourthe Company’s accounting principles, accounting policies, financial and accounting controls, and compliance with legal and regulatory requirements; (7) establishing procedures for the confidential anonymous submission of concerns regarding questionable accounting, internal controls, or auditing matters; (8) reviewing and approving known related person transactions; and (9) overseeing our enterpriseassisting the Board in its oversight of the Company’s risk management program.program, including regularly reviewing the Company’s risk portfolio and the steps management has taken to monitor and control such risks. The Audit Committee generally has eight regularly scheduled meetings per year and has an opportunity at each meeting to speak with the lead audit partner from the Company’s independent registered public accounting firm as well as the Company’s director of internal audit without any other members of management present. In addition, the Audit Committee Chair has regularly scheduled teleconferences with each of the Company’s Chief Financial Officer, the lead audit partner from the Company’s independent registered public accounting firm, the Company’s director of internal audit, and the Company’s director of risk management throughout the year. At the end of each quarter, the Audit Committee reviews and discusses with management and the Company’s independent registered public accounting firm the Company’s financial results, press releases concerning the Company’s financial performance and earnings estimates, any significant control deficiencies identified and steps management has taken or plans to take to remediate any significant control deficiencies, significant estimates and proposed audit adjustments, audit activities, reports to the Company’s ethics hotline, and the results of the Company’s independent registered public accounting firm’s review or audit of its financial statements, among other things. Each year the Audit Committee evaluates the performance of the Company’s independent registered public accounting firm and considers whether it is in the best interests of the Company and its stockholders to engage the firm for another year. As part of its evaluation, the Audit Committee considers the qualifications of the persons who will be staffed on the Company’s engagement, including the lead audit partner, quality of work, firm reputation, independence, fees, retail experience, and understanding of the Company’s financial reporting processes, policies, and procedures. The Audit Committee solicits feedback from management as part of its evaluation process. The Audit Committee also prepares the Audit Committee Report that the SEC rules require to be included in our annual proxy statement. This report is on page 5270 of this proxy statement. The Board has affirmatively determined that (1) each of our Audit Committee members Mr. Devine, Mr. Archbold and Ms. Mangum, meetmeets the definition of “independent director” for purposes of serving on the Audit Committee under both Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the NYSE rules. In addition, the Board determined that Mr. Devine, Mr. Archboldlisting rules, and Ms. Mangum(2) each qualifyqualifies as an “audit committee financial expert,” as such term is defined in Item 407(d)(5) of Regulation S-K. The Audit Committee met seveneight times in 2011.2013. Compensation and Governance Committee The Compensation and Governance Committee is responsible for, among other matters: (1) reviewing and approving key employee compensation goals, policies, plans and programs; (2) reviewing and approving corporate goals and objectives relevant to Chief Executive Officer compensation and evaluating the Chief Executive Officer’s performance in light of these goals and objectives; (3) reviewing and approving, in consultation with or with the approval of the independent directors of the Board, compensation arrangements for ourthe Chief Executive Officer; (4) overseeing the overall performance evaluation process for the Chief Executive Officer; (5) reviewing the performance of and approving compensation arrangements for executive officers other than the Chief Executive Officer; (6) reviewing and approving employment agreements and other similar arrangements between usthe Company and ourits executive officers; (7) reviewing and recommending to the independent directorsBoard compensation arrangements for ourthe independent directors; (8) overseeing management’s administration of stockCompany benefit plans and otherpolicies, including incentive compensation plans; (9) reviewing the Company’s compensation philosophyobjectives to ensure it isthey are appropriate and doesdo not incentivize unnecessary and excessive risk taking; (9)(10) identifying individuals qualified to become members of the Board, consistent with criteria approved by the Board; (10)(11) reviewing stockholder proposals and making recommendations to the Board regarding proposals; (11)(12) overseeing the self-evaluation process for the Board and its committees; (12)(13) overseeing the organization of the Board to discharge the Board’s duties and responsibilities properly and efficiently; (13) identifying best practices and recommending corporate governance principles; and (14) developing and recommending to the Board a set of corporate governance guidelines and principles applicable to us.the Company. The Compensation and Governance Committee also prepares the Compensation and Governance Committee Report that SEC rules require to be included in our annual proxy statement. This report is on page 3451 of this proxy statement. The Board has affirmatively determined that Ms. Mangum, Mr. Killioneach of our Compensation and Mr. Swinburn meetGovernance Committee members meets the definition of “independent director” for purposes of serving on the Compensation and Governance Committee under the NYSE listing rules. The Compensation and Governance Committee met five times in 2011.2013. Compensation Committee Interlocks and Insider Participation OurDuring 2013, Ms. Mangum, Ms. Chawla, and Messrs. Killion and Swinburn served on the Compensation and Governance Committee consistsCommittee. None of Ms. Mangum, Mr. Killion and Mr. Swinburn. During fiscal 2011, at one time or another, Ms. Mangum, Mr. Stefan Kaluzny, Mr. David Dominik and Mr. Sam Duncan werethe members of the Compensation and Governance Committee. Neither Mr. Dominik, Mr. Kaluzny, Ms. Mangum nor Mr. Duncan isCommittee has been an officer or employee or former officer or employee of ours. Mr. Dominik is currently a Managing Director of Golden Gate Capital and Mr. Kaluzny was a Managing Director of Golden Gate Capital until he resigned in January 2011. See “Related Person Transactions” for information on our arrangements with Golden Gate Capital.

the Company. No interlocking relationships exist between the members of the Board or Compensation and Governance Committee and the board of directors or compensation committee of any other company. However, Ms. Mangum and Mr. Weiss serve together onFor additional information about the Board of Directors of Collective Brands, Inc. as well as its Compensation Nominating and Governance Committee.Committee’s activities and processes with respect to compensation matters, please refer to, “Executive Compensation—Compensation Discussion & Analysis—How We Determine Executive Compensation—” on page 36. Succession Planning Our Compensation and Governance Committee reviews the performance of the Company’s executive officers and the succession plans for each officer’s position at least annually. The Committee reports results from the performance reviews and succession plans to the full Board. The full Board has the primary responsibility for reviewing the performance of and the succession plans for the Chief Executive Officer and the succession plan for this position. The Company has a succession plan for the Chief Executive Officer position and the Board regularly reviews and discusses the plan throughout the year. The Board reviews the performance of the Company’s other executive officers and key contributors and the succession plans for each at least annually.

Identifying and Evaluating Director Candidates The Compensation and Governance Committee is responsible for identifying, recruiting, and recommending candidates for the Board and is responsible for reviewing and evaluating any candidates recommended by stockholders. The Compensation and Governance Committee is responsible for developing the criteria for, and reviewing periodically with the Board, the requisite skills and characteristics of nominees, as well as the composition of the Board as a whole. These criteria include independence, diversity, age, skills, and experience in the context of the needs of the Board. The Compensation and Governance Committee considers a combination of factors for each nominee, including the nominee’s ability to represent all stockholders without a conflict of interest; the nominee’s ability to work in and promote a productive environment; whether the nominee has sufficient time and willingness to fulfill the substantial duties and responsibilities of a director; whether the nominee has demonstrated thea high level of character and integrity that we expect;integrity; whether the nominee possesses the broad professional and leadership experience and skills necessary to effectively respond to complex issues encountered by a publicly-traded company; and the nominee’s ability to apply sound and independent business judgment. As a nationally recognized specialty retailer, we believe experience, qualifications, or skills in the following areas are most important: (1) retail merchandising; marketingmerchandising and advertising;operations; (2) apparel and consumer goods; manufacturing, sales(3) consumer brand marketing and distribution;advertising; (4) business development and strategic planning; (5) accounting, finance, and capital structure; strategic planning(6) human resources and organizational design; (7) supply chain; (8) technology development and management experience; (9) leadership of complex organizations; legal/regulatory(10) leadership development and government affairs; people management;succession planning; (11) corporate governance and board practices of other major corporations.public companies; (12) e-commerce; (13) risk management; (14) international and franchise operations; and (15) data analytics. The Board believes that diversity of Board members is important and considers background, experience, skills, race, gender, and national origin when considering diversity. Our Bylaws contain a procedure allowing for the nomination by stockholders of proposed directors. See “Additional Information — Information—Stockholder Proposals for Inclusion in the 20132015 Annual Meeting Proxy Statement” and “—Other Stockholder Proposals” for information as to how a stockholder can nominate a director candidate. The Compensation and Governance Committee considers all director candidates, including candidates proposed by stockholders in accordance with our Bylaws, based on the same criteria. The Compensation and Governance Committee may engage third-party search firms to identify potential director nominees. The Compensation and Governance Committee engaged a third party search firm in 2011 to identify and pre-qualify independent board members which resulted in the appointments of Mr. Archbold, Mr. Swinburn and Mr. Killion. Risk Oversight The Board, with the assistance of the Audit Committee and the Compensation and Governance Committee, reviews and oversees our enterprise risk management (“ERM”) program, which is an enterprise-widea program designed to enable effective and efficient identification and management of critical enterprise risks and to facilitate the incorporation of risk considerations into decision making. The ERM program was established to clearly define risk management roles and responsibilities, bring together senior management to discuss risk, promote visibility and constructive dialogue around risk at the senior management and Board levels, and facilitate and drive appropriate risk response strategies. Under the ERM program, management develops a holistic portfolio of enterprise risks. Management then develops risk response plans for risks categorized as needing management focus and response and monitors other identified risk focus areas. Management provides regular reports on the risk portfolio and risk response and monitoring efforts to senior management and to the Audit Committee. The Audit Committee oversees management’s implementation of the ERM program, including reviewingregularly evaluating our enterprise risk portfolio, and evaluating management’s approach to addressing identifiedidentifying risks, and steps management has taken to manage and monitor enterprise risks. While the Audit Committee has primary oversight responsibility for the risk assessment and management process, theThe Compensation and Governance Committee considers the risks associated withis responsible for risk oversight as it relates to our compensation policies and practices and governance structure and processes. The Board is kept informed of the committees’ risk oversight and related activities primarily through reports of the committee chairmenchairs to the full Board.Board and also receives a comprehensive report from management on the ERM program at least annually. In addition, the Audit Committee escalates issues relating to risk oversight to the full Board as appropriate to provideensure that the Board is appropriately informed of developments that could affect our risk profile or other aspects of our business. The Board also considers specific risk topics in connection with strategic planning and other matters. Analysis of Risk in Our Compensation ProgramsProgram The Compensation and Governance Committee evaluates the risks of itsour compensation programsprogram as part of its overall discussions of the Company’sresponsibilities. The compensation programs. As described below under “Compensation Discussion and Analysis,” our compensation programs are designed to (1) attract, motivate, reward and retain superior executive officers with the skills necessary to successfully lead and manage our business, (2) achieve accountability for performance by linking annual cash incentive compensation to the achievement of measurable performance objectives and (3) align the interests of the executive officers and our stockholders through short- and long-term incentive compensation programs. In addition, the compensation programs areprogram is intended to discourage excessive risk-takingrisk taking by executives and employees to obtain short-term benefits that may be harmful to the Company and our stockholders in the long term. We believe that the following elements of the compensation program discourage excessive risk taking by executives:taking: | | • | | Short-Term/Long-Term Incentive Mix. The mix between short-term cash incentives andlong-term equity-based incentives discourages executives and employees from maximizing short-term performance at the expense of long-term performance. |

| | • | | Long-Term Incentive Mix. We grant a mixture of long-term equity-basedequity incentives, includingcomprised in 2013 of stock options restricted stock and performance-based restricted stock units, sincebecause stock options alone may lead to increased risk-takingrisk taking and performance-based restricted stock and restricted stock unitsawards alone may discourage associatesemployees from taking appropriate risks. Furthermore, our equity-basedOur equity incentives have multi-year vesting and performance features in orderrequirements. Furthermore, grants of performance-based restricted stock units are subject to incentperformance-based vesting conditions. Our long-term incentive awards are designed to incentivize long-term stockholder value creation and to encourage retention. |

| | • | | Short-Term Cash-Incentive Planand Long-Term Incentive Program Design. In order to discourage risk taking, ourboth short-term cash incentive plan allowscompensation awards and long-term performance-based restricted stock awards allow for a graduated payout instead of a win or lose payout structure. The planEach program has a minimum performance threshold below which no payout is earned and a maximum above which no additional payout is earned. In addition, a prorated payout may be earned based on achievement between threshold and target or achievement between target and maximum. |

| | • | | Multiple Performance Measures. Our short-term cash-incentive planprogram has a performance target based on operating income and our performance based equityperformance-based restricted stock awards have performance targets based on earnings per share. The varied performance measures are designed to discourage participants from focusing on the achievement of one performance measure at the expense of another. |

| | • | | Stock Ownership Guidelines and Holding Requirements. We use meaningful stock ownership guidelines to align our directors’ and executives’executive officers’ interests with our stockholders’ interests and ultimately focus our executives on attaining long-term stockholder returns. |

| | • | | Clawback and Anti-Hedging Policies. Our clawback policy allows the Companyus to recapture any incentive compensation paid in the event of a restatement of our financial statements, which discourages inappropriate risk-taking behavior. Our anti-hedging policies further align our executives’ and employees’ interests with those of our stockholders. |

Communications with the Board Stockholders and other interested parties may contact an individual director, including the Lead Director, the Board as a group, or a specified Board committee or group, including the non-employeeindependent directors as a group, at the following address: Office of the Corporate Secretary, Express, Inc., 1 Express Drive, Columbus, OH 43230 Attn: Board of Directors. In accordance with instructions provided by our Audit Committee, your call, report or letter will be distributed as applicable to our Chief Executive Officer, Chief Financial Officer and Chief Legal Officer, who will reviewAny correspondence should clearly indicate whether the correspondence before forwarding it directly tois intended for an individual director, the Board member(s) to whom you wish to communicate.as a group, or a specified committee or group of directors. All such reports or correspondence will be forwarded to the appropriate director or group of directors as described aboveindicated on the correspondence unless they arethe correspondence is of a trivial nature, irrelevant to the Board’s responsibilities, or otherwise not related to accounting, internal controls, auditing matters, corporate governance, or any other significant legal or ethical issues at Express. However, aalready addressed by the Board. A report will be made to the Audit Committee of all call reports or correspondencecommunications to the Board, and all such reports and correspondence areis made available to all directors and are preserved in accordance with our retention policy.directors. Director Independence The Board has reviewed the relationships between us and each of our directorsdirector has with the Company and has determined that all of our directors except for Mr. Archbold, Mr. Devine, Mr. Killion, Ms. Mangum and Mr. SwinburnWeiss are “independent directors” under NYSE listing standardsrules and have either no relationships with us (other than as a director and stockholder) or only immaterial relationships with us. Mr. Weiss is not independent because of his position as our President and Chief Executive Officer. Mr. Olshansky was determined not to be independent because of his position as Managing Director of Golden Gate Capital and our various arrangements with affiliates of Golden Gate Capital since investment funds managed by Golden Gate Private Equity, Inc. (“Golden Gate”) acquired Express in 2007. See “Related Person Transactions” for a description of these agreements and arrangements. Code of Conduct We expect our directors, officers, and employees to act ethically at all times and acknowledge their adherenceto adhere to the policies comprising our Code of Conduct. Stockholders may access a copy of our Code of Conduct onin the investor relations section of our website at www.express.com.www.express.com/investor. We will promptly disclose any waivers of our Code of Conduct involving our principaldirectors or executive officer, principal financial officerofficers. We intend to satisfy any disclosure requirements regarding any amendment or principal accounting officer.waiver of our Code of Conduct by posting the information on the “Corporate Governance” page of our website which can be found at www.express.com/investor. Outside Board Memberships Our Corporate Governance Guidelines provide that directors should not serve on more than four other public company boards. Directors are expected to advise the Chairman in advance of accepting an invitation to serve on another public company board or for-profit private company board and before accepting an assignment to any other public company’s audit or compensation committee. No director may serve as a director, officer, or employee of a competitor of ours. Director Compensation Overview Independent non-employee directors receive compensation for Board service, which is designed to fairly compensate them for their time and effort and align their interests with the long-term interests of our stockholders. Employee directors and directors affiliated with Golden Gate receive no compensation for Board service. The Compensation and Governance Committee, together with its independent compensation consultant, periodically review the form and amount of director compensation and propose any changes to the Board. As part of its review, the Compensation and Governance Committee considers how the Company’s director compensation program compares to the programs at the peer companies we considerreferred to in the executive compensation setting process. See “Executive Compensation — Compensation—Compensation Discussion and Analysis —Analysis—How We Determine Executive Compensation Decision Making Process — Compensation—The Role of Peer Companies and Benchmarking” beginning on page 2537 for more information. The Compensation and Governance Committee believes that director compensation should be competitive with the market and geared towards attracting and retaining highly-qualified independent professionals to oversee the Company and represent the interests of the Company’s stockholders. Eligible non-employee directors arewere paid an annual retainer of $100,000. An additional$100,000 for fiscal year 2013. Each director who serves on a committee of the Board is entitled to a $10,000 is paid annuallyannual retainer for each committee on which a non-employeesuch director serves andserves. In addition, the Chair of the Audit Committee is entitled to an additional $10,000 is paid annually for serving asannual retainer of $15,000, the Chair of the Compensation and Governance Committee. The Chair of the Audit Committee is paidentitled to an additional $15,000 annually for serving in that capacity. In addition, beginning in 2012,annual retainer of $10,000, and the Lead Director will be paidis entitled to an additional annual retainer of $25,000. All retainer fees are payable quarterly, in advance, on the first business day of January, April, July, and October. We do not pay additional fees for attending Board or committee meetings. Eligible non-employee directors also receive equity grants on an annual basis. In 2011,2013, eligible non-employee directors were granted 5,500 restricted stock units which vest ratably on each of the first three anniversaries following the applicable date of grant. In 2012, upon the recommendation of the Compensation and Governance Committee and its independent compensation consultant, directors will receive a number of restricted stock or restricted stock units that havehad a value of approximately $100,000 on the date of grant and willthat vest on the first anniversary of the date of grant. All directors receive reimbursement for reasonable out-of-pocket expenses incurred in connection with meetingsBoard and committee meetings.

Changes for 2014 In 2013, the Compensation and Governance Committee reviewed the Company’s director compensation program. In order to further align director pay with the Company’s financial performance, and upon recommendation from its independent compensation consultant, the Compensation and Governance Committee approved the following changes to director compensation effective for fiscal 2014: (1) a reduction in the annual cash retainer paid to eligible independent non-employee directors from $100,000 to $75,000; and (2) an increase in the annual grant date fair value of restricted stock units granted to eligible non-employee directors from approximately $100,000 to approximately $125,000. All restricted stock units awarded to non-employee directors vest on the first anniversary of the board.date of grant. Director Stock Ownership Guidelines In September 2011, theThe Board of Directors adoptedhas director stock ownership guidelines which call for non-executive directors to own an amount of our common stock equal to the lower of three times their annual cash retainer or 12,000 shares. Directors have five years to meet the guidelines. To avoid fluctuating ownership requirements, and to accommodate changes in Board committee responsibilities, once a director has achieved the minimumapplicable stock ownership levelguideline he or she will beis considered to have satisfied the guideline, provided that the shares used to meet the underlying requirementsrequirement are retained. As of the end of fiscal 2013, all non-executive directors own shares of our common stock and are on track to meet the stock ownership guidelines. For a discussion of the stock ownership guidelines applicable to Mr. Weiss, refer to “Executive Compensation—Compensation Discussion and Analysis—Other Corporate Governance Considerations in Compensation—Stock Ownership Guidelines.”

20112013 Director Compensation Table

The following table sets forth information regarding 2011 compensation earned for each of ournon-employee directors. directors in 2013. | | | | | | | | | | | | | | | | | | | | | | Director (1) | | Fees

Earned

or Paid

in Cash ($) | | | Stock

Awards ($)(2)(3) | | | Option

Awards ($)(2)(3) | | | All Other

Compensation ($) | | | Total ($) | | Michael F. Devine, III | | | $125,000 | | | | $101,805 | | | | - | | | | - | | | | $226,805 | | Mylle H. Mangum | | | $120,000 | | | | $101,805 | | | | - | | | | - | | | | $221,805 | | Sam Duncan (5) | | | $82,500 | | | | $117,810 | | | | - | | | | - | | | | $200,310 | | Stefan L. Kaluzny (4) | | | $97,500 | | | | $101,805 | | | | - | | | | - | | | | $199,305 | | Michael G. Archbold (6) | | | $27,500 | | | | $109,670 | | | | - | | | | - | | | | $137,170 | | David C. Dominik (5) | | | - | | | | - | | | | - | | | | - | | | | - | | Josh Olshansky | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | Director (1) | | Fees

Earned

or Paid

in Cash ($) | | | Stock

Awards ($)(2)(3) | | Total ($) | | Michael G. Archbold | | | 110,000 | | | 99,997 | | | 209,997 | | Sona Chawla | | | 110,000 | | | 99,997 | | | 209,997 | | Michael F. Devine, III | | | 125,000 | | | 99,997 | | | 224,997 | | Theo Killion | | | 110,000 | | | 99,997 | | | 209,997 | | Mylle H. Mangum | | | 155,000 | | | 99,997 | | | 254,997 | | Peter S. Swinburn | | | 110,000 | | | 99,997 | | | 209,997 | |

| (1) | Messrs.Mr. Weiss Dominik and Olshansky did not receive compensation for service on the Board. |

| (2) | Reflects the aggregate grant date fair value of restricted stock units and option awards, respectively.units. These values have been determined based on the assumptions and methodologies set forth in Note 1011 of our financial statements filed with the SEC as part ofincluded in our Annual Report on Form 10-K for the year ended January 28, 2012.February 1, 2014. These amounts do not represent the actual amounts paid to or received by the named director during 2011.2013. No option awardsstock options were granted to any of the company’sCompany’s non-employee directors during 2011.in 2013. |

| (3) | The aggregate outstanding restricted stock units and option awardsstock options (whether or not exercisable in the case of options) outstanding as of January 28, 2012February 1, 2014 are as follows: Mr. Archbold (6,630 restricted stock units); Ms. Chawla (4,796 restricted stock units); Mr. Devine (5,680(6,690 restricted stock units and 10,000 stock options); Mr. Killion (4,796 restricted stock units); Ms. Mangum (5,680(6,690 restricted stock units and 10,0002,500 stock options); and Mr. Archbold (5,500Swinburn (8,463 restricted stock units). |

(4) | Mr. Kaluzny resigned from the Board on November 3, 2011. |

(5) | Mr. Duncan and Mr. Dominik resigned from the Board on January 3, 2012. |

(6) | Mr. Archbold was appointed to the Board on January 3, 2012. |

Executive Officers The following table sets forth the names, ages, and titles of our current executive officers as of April 3, 2012:14, 2014: | | | | | | | | | | | Name | | | | Age | | | | | Position | Michael A. Weiss | | | 70 | | | 72 | | | | | Chairman President & Chief Executive Officer | David G. Kornberg | | | | | 46 | | | | | President | Matthew C. Moellering | | | 45 | | | 47 | | | | | Executive Vice President & Chief Operating Officer | Colin Campbell | | | 53 | | | 55 | | | | | Executive Vice President—Sourcing and Production | Lisa A. GavalesMichael C. Keane

| | | | | 4850 | | | | | Executive Vice President—Chief Marketing Officer | Fran Horowitz-Bonadies

| | | 48 | | | Executive Vice President—Women’s Merchandising and Design | David G. Kornberg

| | | 44 | | | Executive Vice President—Men’s Merchandising and DesignHuman Resources | John J. (Jack)(“Jack”) Rafferty | | | 60 | | | 62 | | | | | Executive Vice President—Planning and Allocation | Jeanne L. St. Pierre | | | 52 | | | 54 | | | | | Executive Vice President—Stores | Douglas H. Tilson | | | 54 | | | 56 | | | | | Executive Vice President—Real Estate | D. Paul Dascoli | | | 51 | | | 53 | | | | | Senior Vice President, Chief Financial Officer & Treasurer |

Our executive officers are appointed by our Board and serve until their successors have been duly elected and qualified or their earlier resignation or removal. There are no family relationships among any of our directors or executive officers. Set forth below is a description of the background of the persons named above, other than Mr. Weiss, whose background information is provided above in “Election Of Directors (Proposal No. 1).” on page 9. David G. Kornberg has served as our President since October 2012. Mr. Kornberg first joined Express in 1999 and has held various roles of increasing responsibility, including as Executive Vice President of Men’s Merchandising and Design from December 2007 to October 2012 and General Merchandise Manager of the Express Men’s business prior to that. From 2002 to 2003, Mr. Kornberg was Vice President of Business Development with Disney Stores. Mr. Kornberg spent the first ten years of his career with Marks & Spencer PLC in the United Kingdom. Matthew C. Moelleringhas served as our Executive Vice President & Chief Operating Officer since September 2011. Prior to that, he served as our Executive Vice President, Chief Administrative Officer, Chief Financial Officer, Treasurer and Secretary from October 2009 to September 2011, Senior Vice President, Chief Financial Officer, Treasurer and Secretary from July 2007 to October 2009 and our Vice President of Finance from September 2006 to July 2007. Prior to that, he served in various roles with Limited Brands from February 2003 to September 2006, most recently asincluding Vice President of Financial Planning. Prior to that, Mr. Moellering served in various roles with Procter and Gamble where he was employed from July 1995 until February 2003 and prior to that as an officer in the United States Army. Mr. Moellering serves on the board of directors of L.L.Bean, Inc. which is a privately held company. Colin Campbellhas served as our Executive Vice President of Sourcing and Production since June 2005. Prior to that, from March 1997 to June 2005, Mr. Campbell held a number of leadership positions for various divisions of Limited Brands including Cacique and Limited Stores and was an Executive Vice President of Western Hemisphere Operations at Mast from 2003 to 2005. Prior to that, from 1985 to 1997, Mr. Campbell was Vice President of Operations for the dress division of Liz Claiborne. He has also worked in production leadership positions with Bentwood Brothers LTD in England and Daks-Simpson LTD in Scotland. Lisa A. GavalesMichael C. Keanehas served as our Executive Vice President and Chief Marketing Officer since January 2008. Prior to that, she worked with Bloomingdale’s for 13 years in a number of merchandising and marketing roles, most recently as Senior Vice President of Marketing from 2000 to 2007. Ms. Gavales has also worked as a management consultant for Pricewaterhouse and Habberstad International. She began her career in the training program at R. H. Macy’s & Co.

Fran Horowitz-Bonadieshas served as our Executive Vice President of Women’s Merchandising and DesignHuman Resources since December 2007. Prior to that, sheMarch 2012. He served as our Senior Vice President and General Merchandise Manager from December 2005 to December 2007. Prior to that, she served as our Vice

President and Merchandise Manager from March 2005 to December 2005. Prior to that, she worked at Bloomingdale’s for 13 years in various merchandising roles. Ms. Horowitz-Bonadies also worked early in her career in buying positions at Bergdorf Goodman, Bonwit Teller and Saks Fifth Avenue.

David G. Kornberghas served as our Executive Vice President of Men’s Merchandising and Design since December 2007. He served as our Senior Vice President and General Merchandise ManagerHuman Resources & Stores for Tween Brands, a wholly-owned subsidiary of Ascena Retail Group, Inc. from 2005October of 2011 to December 2007.March of 2012. Prior to that, he was aserved as Senior Vice President of BusinessHuman Resources for Tween Brands since August 2007. From April 2006 to August 2007 he served as Executive Vice President of Human Resources for

Victoria’s Secret, and prior to that served as Vice President of Human Resources for Express from August 2001 to April 2006. Prior to that, Mr. Keane served as Director of Associate Development at Express from May 2001 to August 2001 and before that joined Limited Brands in August 2000 as Director of HR in the Structure brand. Mr. Keane served as Director of Associate Development with Disney Stores. Mr. Kornberg spent the first ten yearsBorden Foods Corporation from 1995 to 2000 and as Director of his careerLeader Development with Marks & Spencer PLC in the United Kingdom.Whirlpool Corporation from July 1990 to September 1995. John J. (“Jack”) Raffertyhas served as our Executive Vice President of Planning and Allocation since 1999 after joining Express as Vice President of Planning and Allocation in 1998. Prior to joining Express, Mr. Rafferty held a number of planning and allocation leadership roles with Limited Brands. These roles include Vice President of Planning and Allocation for Lerner from 1990 to 1998, Vice President of Lane Bryant from 1988 until 1990 and Director of Planning and Allocation for Sizes Unlimited from 1984 to 1986. Mr. Rafferty started his career in various planning and allocation roles with Korvettes, Casual Corner and Brooks Fashion. Jeanne L. St. Pierrehas served as our Executive Vice President of Stores since March 2004. BeforePrior to joining Express, she was the Zone Vice President for Bath & Body Works from November 1998 until March 2004, and prior to that, she served as both a Regional Vice President and a District Manager with Ann Taylor. Ms. St. Pierre was also a District Manager and Store Manager for Abercrombie & Fitch, and early in her career she held various management and sales positions with Talbots and Casual Corner, and as an Allocator for Express. Douglas H. Tilsonhas served as our Executive Vice President of Real Estate since October 2009. Prior to that, he served as our Senior Vice President of Real Estate from October 2007 to October 2009. Prior to that, he was with Steiner & Associates as Senior Vice President of Leasing from April 2005 until October 2007. Prior to that, Mr. Tilson was Senior Vice President of Real Estate for Tween Brands from July 1999 until April 2005 and served in a number of senior Real Estate positions with Limited Brands from January 1987 until July 1999. Prior to that, he was a labor attorney with the Columbus, Ohio-based law firm Porter, Wright, Morris & Arthur LLP from June 1984 until January 1987. D. Paul Dascolihas served as our Senior Vice President, Chief Financial Officer and Treasurer since September, 2011. Prior to joining Express, Mr. Dascoli served as Vice President and Chief Financial Officer of VF Jeanswear Limited Partnership a division of VF Corporation, since 2006. Prior to that, Mr. Dascoli held a number of senior level financial, administrative and operations positions with Thomasville Furniture Industries, Inc., a division of Furniture Brands International, including Executive Vice President from 2003 to 2006, Senior Vice President Finance & Administration and Chief Financial Officer from 1998 to 2003, and Vice President and Chief Financial Officer from 1996 to 1998. Prior to that, Mr. Dascoli was Vice President Financial Operations for Revlon Consumer Products Company from 1994 to 1996. Prior to that, he was employed in a number of financial roles with PepsiCo, Inc., including Area Chief Financial Officer for the St. Louis, Missouri and Ontario, Canada bottling operations. Mr. Dascoli started his career with Peat Marwick Mitchell & Co., now KPMG. Mr. Dascoli serves on the board of directors, and is the chair of the Audit Committee, of Stanley Furniture Company, Inc. Executive Compensation Compensation Discussion and Analysis Introduction This Compensation Discussion and Analysis (“CD(the “CD&A”) provides you with information regarding our executive compensation program. To assist you in your review, we have organized the information into the following sections: The Executive Summaryreviews the Company’s 2013 business performance and shows how our pay for performance philosophy impacted CEO compensation over the Company’s last three fiscal years; Executive Compensation Objectives and Practicessummarizes our executive compensation objectives and practices including changes to our executive compensation program in 2013; Pay For Performanceillustrates the strong alignment between our executive compensation program and the Company’s financial performance; How We Determine Executive Compensationdescribes the process the Compensation and Governance Committee (the “Committee”) follows and the factors it considers when making executive compensation decisions; What We Pay and Why: Elements of Compensationdescribes the compensation arrangements we have withelements of our Named Executive Officers (“NEOs”) as required under2013 executive compensation program; and Other Corporate Governance Considerations in Compensationaddresses the rulesother policies and practices that impact our executive compensation program. This CD&A focuses on the compensation of the SEC. The SEC rules require disclosure for our principal executive officer and our principal financial officer, regardless of compensation level, and our three most highly compensatednamed executive officers (our “NEOs”) for 2013, who did not serve as the principal executive officer or principal financial officer at any time during our last completed fiscal year. We are including information for six NEOs because two people served as our principal financial officer in 2011. Mr. Moellering was our principal financial officer until September 2011 when he was promoted to Chief Operating Officer and Mr. Dascoli was appointed as our principal financial officer. Our NEOs are:were:

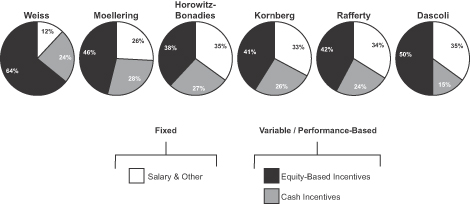

| | | | Name | | Position | | | | Michael A. Weiss | | Chairman President & Chief Executive Officer | | | David G. Kornberg | | President | | | | Matthew C. Moellering | | Executive Vice President & Chief Operating Officer | | | | Fran Horowitz-BonadiesColin Campbell

| | Executive Vice President—Women’s MerchandisingSourcing and Design | | | David G. Kornberg

| | Executive Vice President—Men’s Merchandising and Design | | | John J. (“Jack”) Rafferty

| | Executive Vice President—Planning and AllocationProduction | | | | D. Paul Dascoli | | Senior Vice President, Chief Financial Officer & Treasurer |

Executive Summary Core Principles.Overview of Fiscal 2013 Business Results

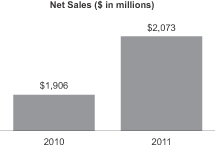

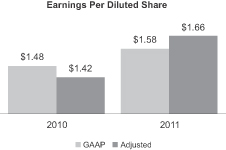

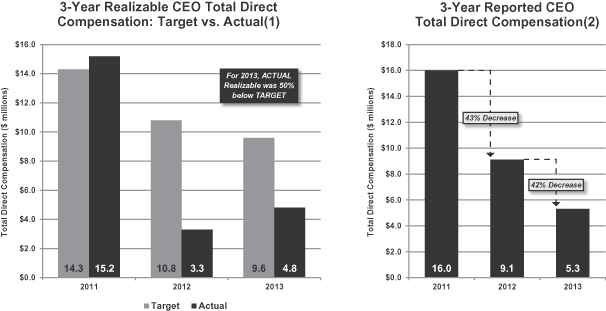

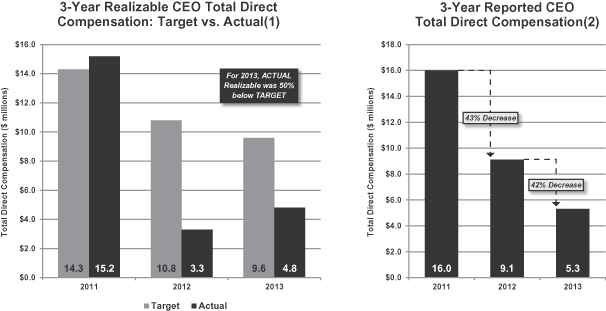

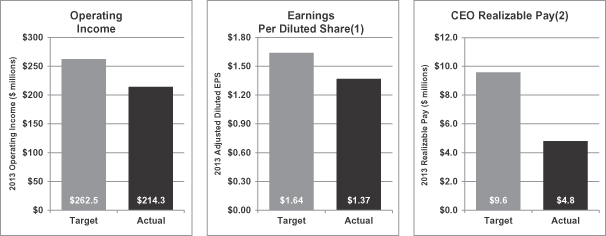

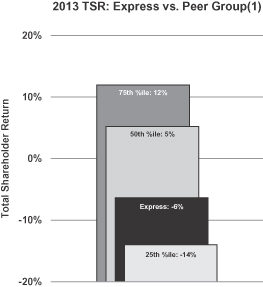

We operatemade significant progress in 2013 with respect to three of our four growth pillars amidst a competitivechallenging retail environment. Our e-commerce business continued to grow rapidly. E-commerce sales in 2013, a 52-week fiscal year, increased 25% compared to 2012, a 53-week fiscal year, and generated more than 15% of our total net sales. In terms of real estate growth, we added 16 new stores in North America (7 net of store closures), including our San Francisco flagship store. We also completed the strategic plan associated with our new outlet store initiative and laid the groundwork for the April 2014 opening of our first Express Factory Outlet store. Progress was also made in terms of our international expansion plan. We added 11 net new franchise stores throughout the Middle East and Latin America, and we entered into a new franchise arrangement to bring the Express brand to South Africa. In 2013, net sales increased 3% over 2012 to $2.2 billion, and comparable sales increased by 3% over the prior year. This did not, however, translate into operating income, net income, or earnings per share growth. Specifically, operating income declined to $214.3 million compared to $251.6 million in 2012, net income decreased to $116.5 million, compared to net income of $139.3 million in 2012, and earnings per diluted share declined to $1.37 from $1.60 in 2012. It is important to note that 2012 benefited from a 53rd week, which contributed approximately $27.0 million to net sales, approximately $5.2 million to operating income, approximately $3.1 million to net income, and approximately $0.04 to earnings per diluted share in 2012. Due to the heightened promotional environment, we increased the depth and duration of our promotions. The increase in our promotional activity negatively impacted our gross margin rate, which fell from 34.4% in 2012 to 32.3% in 2013. In 2013, we also continued to invest in the information technology upgrades that are key to our evolution to a truly omni-channel business. These were significant factors contributing to the operating income, net income, and earnings per share declines. While the challenging industry. Weretail environment prevented us from delivering the productivity gains we anticipated for 2013, we are confident that we took the right steps to navigate the challenges we faced and to position ourselves to be a successful omni-channel retailer over the long term. In 2014, we will continue to focus on the execution of our growth pillars. Even in this difficult environment, we believe ourthat significant opportunities exist for Express to drive increases in stockholder value. Relationship Between Business Performance and CEO Compensation Our executive compensation programs should beprogram is designed to (1) attract, motivate, reward and retain superiorstrongly align executive officerscompensation with the skills necessary to successfully leadCompany’s financial performance. In 2013, 84% of target total direct compensation for our CEO was performance-based, and managethe performance targets we established were challenging. The performance targets established for the Company’s short-term cash incentive program and performance-based restricted stock units were not fully achieved. Accordingly, in 2013, realizable total direct compensation for our business, (2) achieve accountability for performance by linking annualCEO was 50% below target reflecting that (i) no cash incentive compensation was paid, (ii) performance-based restricted stock units were earned at 83.5% of target, and (iii) no payout is currently expected under the special one-time cash retention award granted to our CEO in 2013. Highlighting the achievementstrong alignment between pay and performance, the chart below on the left illustrates our CEO’s actual realizable total direct compensation as compared to target realizable total direct compensation over the Company’s last three fiscal years. The chart on the right shows the significant decrease in our CEO’s total direct compensation as reported in the Summary Compensation Table on page 52 during the same three year period.

(1) Refer to “—Pay For Performance—CEO Realizable Pay” on page 35 for detailed information regarding realizable total direct compensation. (2) Reported Total Direct Compensation is comprised of measurable performance objectivesbase salary, short-term incentives, and (3) alignlong-term incentives as reported in the interests ofSummary Compensation Table on page 52. Reported Total Direct Compensation excludes non-qualified deferred compensation earnings and all other compensation reported in the executive officers andSummary Compensation Table. CEO Realizable Total Direct Compensation vs. Reported Total Direct Compensation We believe that showing realizable total direct compensation provides important supplemental information to assist our stockholders through short- and long-term incentive compensation programs. Accordingly, the core principles that underliein understanding our executive compensation program because it shows the value of the total direct compensation actually earned by our CEO as of the end of the fiscal year. The amounts shown in the chart above on the right and reported in the Summary Compensation Table on page 52 include the following:grant date fair value of performance-based restricted stock awards at target, without regard to whether they were actually earned. In 2012, our CEO did not receive any performance-based restricted stock because the performance threshold was not met, however, the Summary Compensation Table includes the grant date value of the performance-based restricted stock at target, which had a value of approximately $4.6 million. In 2013, our CEO actually earned performance-based restricted stock units at 83.5% of target. Further, with respect to stock options, the Summary Compensation Table reports the grant date fair value of the stock options as calculated in accordance with generally accepted accounting principles (“GAAP”), while actual realizable total direct compensation reflects any amounts actually received by our CEO through the exercise of stock options plus the actual value that would be received by our CEO upon the exercise of the outstanding stock options as of each fiscal year end, many of which are currently underwater. Accordingly, we believe that realizable total direct compensation better represents the alignment between pay and performance. Executive Compensation Objectives and Practices The core objectives that serve as the foundation for our compensation program are: | | | | | | Program Objective | | Achievement of Objective | | Pay for Performance | | • A significant portion of our executives’ target pay is not guaranteed and is tied to business performance. | | • Our performance targets are achievable, yet challenging. For information regarding the Company’s 2013 performance targets and their effect on 2013 pay, See “—Pay For Performance—The Alignment Between Pay and Performance in 2013” on page 34. | | Pay Competitively | | • Our executive compensation program is designed to enable us to compete effectively for the executive talent we need to be able to successfully execute our strategic plans. | | • Executives are rewarded with above-target pay when Company goals are exceeded. | Pay Responsibly - Stockholder

Alignment | | • A meaningful portion of NEO pay opportunity is variable (delivered through the combination of short-term and long-term incentive awards) where the value is linked to achievement of Company financial performance targets and changes in stock price. | | • Each of our NEOs is subject to substantial stock ownership requirements. | | Pay Responsibly - Discourage Excessive Risk Taking | | • The mix between short-term incentives and long-term incentives is intended to discourage executives and employees from maximizing short-term performance at the expense of long-term performance. | | • Our short-term cash-incentive program has a performance target based on operating income and our performance-based restricted stock units have performance targets based on earnings per share, thereby discouraging participants from focusing on the achievement of one performance measure at the expense of another. | | • Our incentive cash and equity awards are capped. | | • Our NEOs are subject to a clawback policy and policies prohibiting hedging and other speculative activity. | | • Refer to page 19 for additional information regarding risk considerations. |

Below we highlight certain executive compensation practices, including practices we have implemented to strongly align executive compensation with the Company’s financial performance, and practices we have not implemented because we do not believe they would serve our stockholders’ long-term interests. | | | | What We DO: | þ | | Pay for Performance—Our executive compensation program is designed to tie executive pay to the Company’s financial performance. A meaningful portion of our executives’ compensation is incentive-based and contingent upon Company financial performance and appreciation in the Company’s stock price. | | | þ | | Annual Advisory Vote on Executive Compensation (Say-on-Pay)—We offer our stockholders the opportunity to vote annually on the Company’s executive compensation program. Refer to page 72 for more information about the non-binding say-on-pay proposal. | | | þ | | Performance-Based Equity Awards—In 2013, all equity awards granted to our NEOs were comprised of a mix of performance-based restricted stock units, with performance based on adjusted earnings per diluted share, and stock options. For our CEO, approximately 65% of the grant date fair value (at target) of the equity awards were comprised of performance-based restricted stock units. | | | þ | | Challenging Performance Targets—We establish performance targets for our executive compensation program that are achievable, yet challenging. Our NEOs earned compensation amounts significantly below target level for both 2012 and 2013, which demonstrates the rigor of our performance targets. | | | þ | | Stock Ownership Guidelines—We have stock ownership guidelines for all executive officers and Board members. We believe these requirements, combined with certain other elements of our overall compensation program, provide executive officers and directors with appropriate incentives to create long-term value for stockholders while taking thoughtful and prudent risks to grow the value of Express. | | | þ | | Regular Review of Share Utilization—We evaluate share utilization by reviewing ongoing grants, forfeitures, overhang levels (dilutive impact of equity compensation to our stockholders), and annual run rates (the aggregate shares awarded as a percentage of total outstanding shares). | | | þ | | Peer Group Comparison—The Committee reviews our peer group annually and makes changes as appropriate. The Committee approved changes to our peer group in 2012 as part of its process for establishing executive compensation in 2013 and made an additional change to our peer group in 2013 that will be used by the Committee when making executive compensation decisions for 2014. See page 37 “—How We Determine Executive Compensation—The Role of Peer Companies and Benchmarking.” | | | þ | | Clawback Policy—Consistent with our objective to pay responsibly and discourage excessive risk taking, the Company maintains a recoupment policy whereby incentive compensation paid to our NEOs and other key executives is subject to adjustment and recovery in the event of certain financial restatements or fraudulent activities. See “—Other Corporate Governance Considerations in Compensation—Compensation Clawback Policy.” | | | þ | | Independent Compensation Consulting Firm—The Committee is advised by an independent compensation consulting firm that provides no other services to the Company. | | | þ | | Mitigate Undue Risk- Our compensation program is designed to drive financial performance and create stockholder value without encouraging inappropriate or excessive risk-taking. We take steps to mitigate undue risk associated with our compensation program through caps on potential payments, clawback provisions, stock ownership guidelines, multiple performance targets, and robust Board and management processes to identify risk. We do not believe that the Company’s |

| | | | | | | executive compensation program creates risks that are reasonably likely to have a material adverse impact on the Company, which we validate through our risk assessment of incentive-based compensation programs each year. Refer to page 19 for additional detail regarding risk considerations. | | | þ | | Review Tally Sheets—The Committee reviews tally sheets for our NEOs prior to making annual executive compensation decisions. Tally sheets provide a comprehensive line item view of compensation where each component of compensation is tallied up. |

| | | | What We DON’T DO: | x | | No Special Tax Gross-Ups—We do not provide special tax gross-ups to executives. | | | x | | No Pension Plans or Other Post-Employment Defined Benefit Plans—We do not provide any qualified or non-qualified post-employment defined benefit plans. | | | x | | No Repricing of Underwater Stock Options or Reloads of Stock Options—The Company’s 2010 Incentive Compensation Plan, as amended (the “Plan”), prohibits the repricing of stock options without the consent of stockholders and does not allow for reloads of stock options to the extent stock options are used to pay the exercise price or taxes with respect to stock option exercises. | | | x | | No Hedging or Pledging Transactions—We prohibit employees, including NEOs and directors, from hedging any securities of the Company held by them. Pledging of Company securities is permitted only with pre-approval, but the Company has never approved a pledging transaction following our IPO and does not intend to absent special circumstances. | | | x | | No Single Trigger Change-in-Control Payments- Our NEOs are not currently entitled to any single-trigger special vesting, severance, or other benefits in a change-in-control. |

2013 Committee Actions Key changes to our executive compensation program for 2013 included: | | • | | Pay-for-PerformanceAnnual Advisory Vote on Executive Compensation (Say-on-Pay):. OurAt our 2011 annual meeting, our stockholders voted to hold an advisory vote on our executive compensation programs are designedprogram once every three years. Although SEC rules did not require the Company to hold another advisory vote to determine the frequency of future advisory say-on-pay votes until 2017, based on stockholder feedback gathered since our 2011 annual meeting, the Committee and Board believed that more of our stockholders preferred to have a meaningful portion of an NEO’s actual pay linkedopportunity to express their views on the Company’s actual performance. We accomplish thisexecutive compensation program on an annual basis. As such, at the Company’s 2013 annual meeting, the Board, upon recommendation by utilizing “performance-based” pay programs like our seasonal cash incentive planthe Committee, gave stockholders the opportunity again to cast an advisory vote to determine the frequency of future advisory votes on executive compensation even though not required. The Board recommended that is tied to key financial metricsstockholders vote in favor of holding an advisory say-on-pay vote on an annual basis and stockholders expressed strong support for the Board’s recommendation with approximately 87% of the Company. In addition, a significant portionvotes cast in favor of totalholding an annual advisory say-on-pay vote. Accordingly, we now offer our stockholders the opportunity to vote annually on the Company’s executive compensation is delivered inprogram. Refer to page 72 for more information about the form of equity-based award opportunities to directly link compensation with stockholder value.non-binding say-on-pay proposal.

|

| | • | | Pay Competitively.Performance-Based Restricted Stock Units: We are committed to providing a totalContinuing our progress toward increasing the performance-based nature of our executive compensation program, designed to retain2013 marked the first year in which all of our high-caliber performers and attract superior leaders to our company. To achieve this goal, we annually compare our pay practices and overall pay levelsNEOs had the same performance target associated with our peer group when establishing our pay guidelines.their performance-based restricted stock units, which was set at adjusted earnings per diluted

|

| share of $1.64 for 2013, an increase of 5% over the comparable 52-week period in 2012. When we initiated our transition to performance-based restricted stock awards in 2012, the performance target for our NEOs, excluding the CEO, was positive adjusted earnings per share. We believe that granting restricted stock units with performance-based vesting criteria is a good governance practice that strengthens the alignment between our executive compensation program and stockholder interests. Refer to “—What We Pay And Why: Elements of Compensation—Long-Term Incentives—2013 Performance-Based Restricted Stock Units” on page 43 for additional information. |

| | • | | Pay Equitably.Special One-Time Performance-Based CEO Retention Award: We believeIn April 2013, the Committee determined that it is important to apply generally consistent guidelines for all executive officer compensation programs. Inin order to deliver equitable pay levels,support the CompensationBoard’s succession planning process and Governance Committee (the “Committee”) considersdesire for leadership continuity, a special one-time cash award should be granted to Mr. Weiss to incentivize his retention. It was further determined that the depthaward should be performance-based. Accordingly, the amount of the award is based on comparing the total shareholder return of the Company relative to that of the companies in the S&P 500 over the two-year period commencing on February 3, 2013, the first day of the Company’s 2013 fiscal year, and scopeending on January 31, 2015, the last day of accountability, complexitythe Company’s 2014 fiscal year. Refer to “—What We Pay and Why: Elements of responsibility, qualifications and executive performance, both individually and collectively as a team.Compensation—Long-Term Incentives—Succession Planning & Special CEO Retention Award” on page 45 for more detailed information regarding the award.

|

| • | | Reduction in CEO Pay Opportunity:CEO realizable total direct compensation at target in 2013, excluding the special one-time cash retention award, was significantly lower in 2013 than in either 2012 or 2011, reflecting a 30% decrease from 2012 and a 47% decrease from 2011. Refer to “—Pay For Performance—CEO Realizable Pay” on page 35 for more detailed information. |

| • | | Peer Group:For purposes of determining 2013 executive compensation, the Committee updated the group of peer companies used for compensation comparison purposes. As a result of the changes, which reduced the peer group median for revenue and market capitalization, the peer group is now closer in size to the Company in terms of revenue and market capitalization than it was prior to the changes. See page 37 “—How We Determine Executive Compensation—The Role of Peer Companies and Benchmarking” for additional information. |

| • | | Changes to Severance Arrangements for our Other NEOs:In April 2013, as part of the Committee’s annual review of executive compensation arrangements, the Committee approved changes to the severance arrangements for Messrs. Kornberg, Moellering, Campbell, and Dascoli in order to make them more competitive and to bring them in-line with the severance arrangements offered by the Company’s peer group. Under the amended severance arrangements: (1) if a qualifying termination occurs that is not in connection with a change-in-control, the executive is generally eligible to receive 18 months of base salary continuation, the amount of cash incentive compensation that he would have otherwise received during the 12 months following termination, and certain medical benefits; and (2) if a qualifying termination occurs in connection with a change-in-control, the executive is generally eligible to receive a one-time payment equal to (a) two times the executive’s annual base salary plus 1.5 times the executive’s annual cash incentive compensation at target, (b) automatic vesting of any unvested outstanding equity awards (at target with respect to performance-based restricted stock awards), and (c) certain medical benefits. Refer to “—Employment Related Agreements—Other Employment Agreements Entered into Prior to the IPO” beginning on page 58 for additional information. |

Compensation Approach.Outcome of 2013 Say-On-Pay Vote

At the Company’s 2013 annual meeting, we held a stockholder advisory vote on executive compensation. Stockholders demonstrated strong support for the compensation of our NEOs with approximately 94% of the votes cast in support of this “say-on-pay” proposal. The Committee’s approach toCommittee considered this vote as demonstrating strong support for the overall design and results of our compensation program involves (a) independent decision-making, (b) utilizing peer group data to appropriately target compensation levels, (c) following a consistent, rigorous target setting process,in 2012, which included strong alignment between pay and (d) risk assessment. This approach is a key feature in ensuring that actual compensation and planperformance. For 2013, the overall design are consistent with our core principles. 2011 Compensation in Review and Other Highlights of our Compensation Program.

In 2011 we received strong stockholder support for our executive compensation program with over 70%remained largely unchanged. Just as in 2012, a meaningful portion of our stockholders votingNEO’s pay opportunity was variable (delivered through the combination of short-term and long-term incentive awards) where the value was linked to stock price appreciation and the Company’s achievement of challenging performance targets. As a result, in favor2013, just as in 2012, the challenging performance targets resulted in strong alignment between pay and performance with our NEOs earning performance-based compensation amounts that were significantly below target.

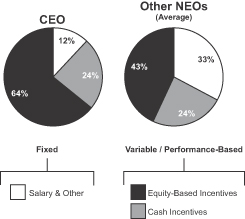

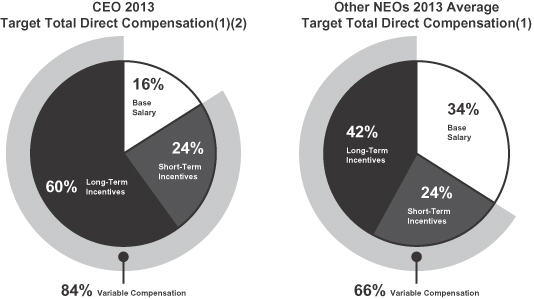

Pay For Performance Performance-Based Compensation Company Performance. We tie a significant portion of our say-on-pay proposal. Despite this strong support, the Committee recognizes that market practices and stockholder views continue to evolve at a rapid pace. In recognition of this, as well as long-range business plans and executive talent needs, the Committee made several changes to our executive compensation program. Our 2011to the Company’s financial results and stock price in order to achieve our objective to pay for performance. As shown in the charts below, for 2013, 84% of CEO compensation decisions and practices66% of other NEO compensation at target was performance-based.